Video games and shooters have been entwined since the early ‘90s. The genre shot into popularity with the release of id software’s DOOM, selling nearly 10 million copies in just two years and generating hundreds of clones. Fast track a decade later, and in 2007, Call of Duty became a household name after the breakout success of Modern Warfare, with the blockbuster franchise amassing more than $30bn in lifetime sales.

As shooter games continued to grow in popularity and spin out into new subgenres, it was only a matter of time until developers turned their sights to the mobile market – but the biggest barrier was the lack of controllers. For a long time, shooter games on mobile were a niche genre, and the touch-screen controls were considered cumbersome compared to their console counterparts which use dedicated controllers.

In recent years, however, mobile shooters such as Call of Duty, Free Fire, and PUBG: Mobile have soared to the top of the charts. Much of that success is owed to gaming’s ‘Battle Royale boom.’ Fortnite has become a worldwide phenomenon, and battle royale shooters such as Free Fire and PUBG: Mobile have established themselves as worthy competitors. Call of Duty has also established itself on smaller screens with a mobile iteration of its blockbuster franchise, complete with its own battle royale mode.

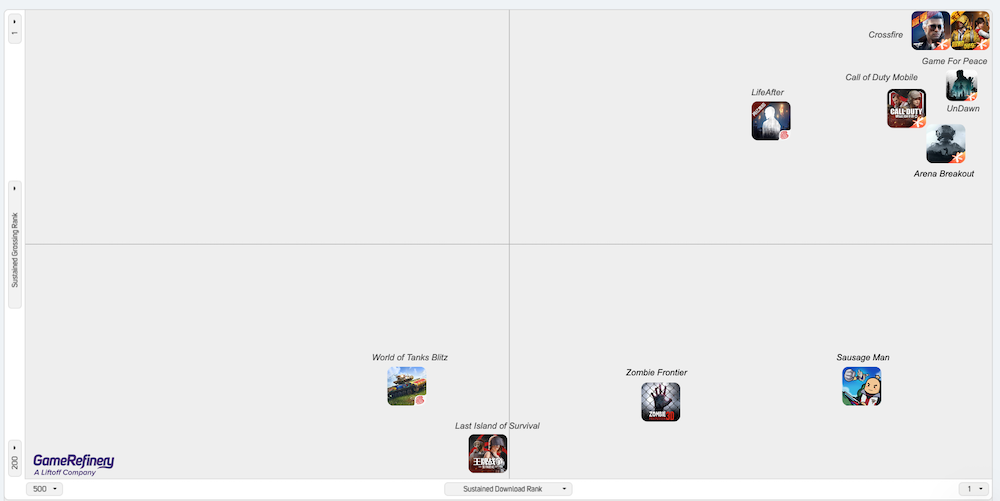

But is the market becoming oversaturated? Below, we take a deeper dive into the highest-grossing and most downloaded shooters on the mobile market to see which subgenres developers should be focussing on if they want to make an impact in the shooter space.

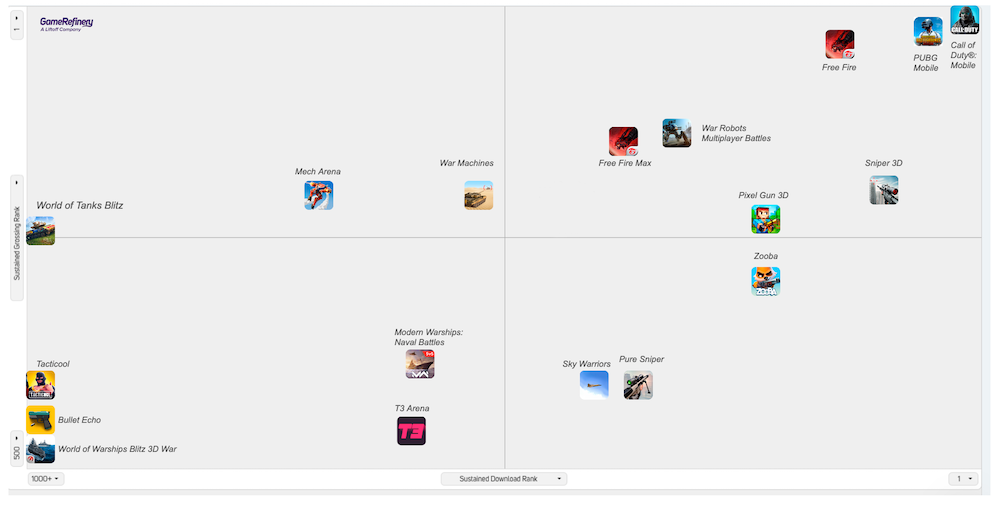

The most popular mobile shooters

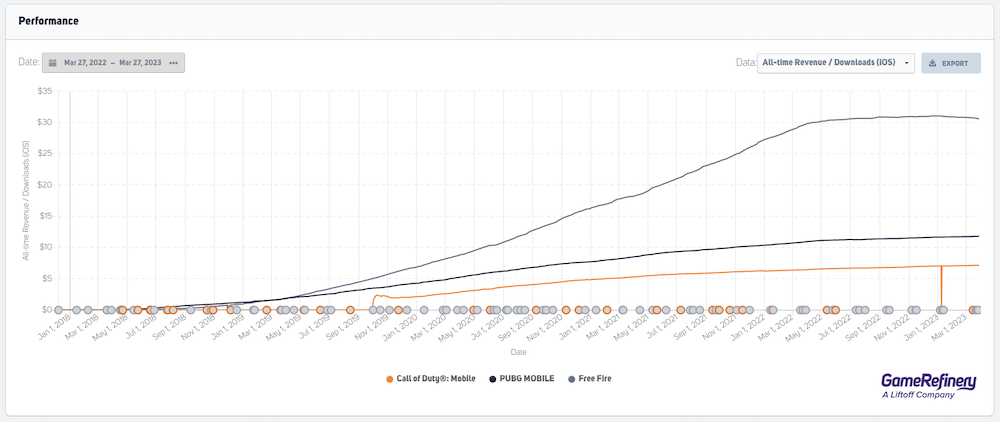

Three titles dominate the US iOS shooter market: Call of Duty: Mobile, PUBG MOBILE, and Free Fire. These three take up about 80% of the market share in the West, with the rest (20%) being evenly divided across other titles. These three titles heavily focus on cosmetic in-app purchases (IAP). For example, players can acquire decorative skins for their characters, companions, vehicles, and weapons through gacha mechanics, battle passes, or direct purchases.

Free Fire differentiates from the other two top dogs as even though the main focus of its in-app purchases is cosmetic, the items for sale also provide character and weapon buffs. The top-end weapon skins, for instance, change the attributes of weapons slightly to give a slight edge in competitive play, while characters and pets can be upgraded with various skills that modify gameplay.

Given that Free Fire doesn’t have the same IP recognition that PC and console powerhouses like Call of Duty and PUBG have, the developers likely felt the need to give players an extra incentive to buy into the game. The result speaks for itself; Free Fire has way higher revenue per download than its competitors, with around $29 ARPD compared to PUBG Mobile’s $12 ARPD and Call of Duty: Mobile’s $7.30 ARPD.

Regarding the broader market, most shooters among the top-grossing 500 focus their monetization on upgrades and other powerful in-app purchases—this can likely be attributed to the demands of fuelling a purely cosmetic business model.

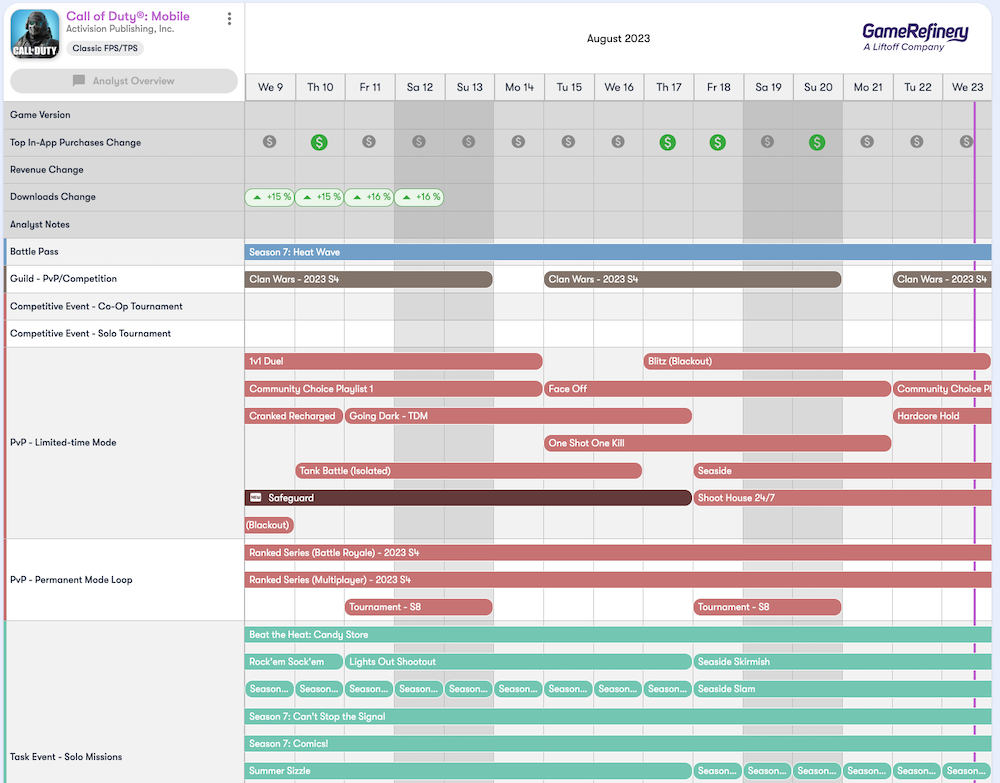

Players must regularly be provided with exciting new playable content alongside a raft of purchasable cosmetics to fuel the in-game economy. Titles like Call of Duty achieve this every month with new classes, maps, game modes, and more due to being based on a blockbuster franchise. Smaller studios would no doubt struggle to keep up, so they opt for power progression to gain a higher revenue per download and enable a more sustainable, less content-driven model.

However, this does come with certain downsides. Tying player progression to monetization is often criticized by players for being ‘pay-to-win,’ particularly in genres heavily focused on competitive multiplayer. If a delicate balance isn’t achieved, there can be backlash amongst players, which can lead to negative reviews flooding in for your game.

Which shooter subgenres should developers pursue?

With Call of Duty, PUBG, and Free Fire dominating the mobile shooter market, many developers may wonder if competing in the shooter genre is worthwhile.

While it is undoubtedly crowded, those who dig deeper will find a surprising amount of uncovered ground in this genre. In fact, roughly four categories could be explored more in the mobile game market: extraction shooters, RPG-like looter shooters, survival shooters, and tactical FPS games. Let’s take a deeper dive into these subgenres.

Extraction shooters

Extraction shooters are one of the less crowded shooter subgenres and move slower than other titles. The aim is to go into a match, loot items, kill enemies within a time limit, and extract from the area before or when the time runs out. These games are usually PvPvE (player vs. player vs. enemy). Popular titles on the PC and console market include Escape from Tarkov and Hunt: Showdown.

One of the few extraction shooters to make headway on mobile platforms (particularly in the Chinese market) is Arena Breakout — a realistic-style FPS game with some survival elements, such as a highly complex health system.

Players participate in PvPvE matches against NPCs and other players in two game modes, either with pre-equipped items or without owned items. During the match, players must consider their physical health level, find equipment and items to loot, kill off enemies and evacuate safely within the time limit.

Arena Breakout has a distinctive monetization model. Unlike other shooters, it does not focus on cosmetics or power progression but instead on collecting items that can be traded and lost in the battle. Pushing players towards purchasing safety boxes to save their most precious items from being stolen differentiates Arena Breakout from the more power-orientated progression shooters, as even if weapons can be somewhat upgraded, there is still a need to purchase a safety box to keep items secure. While in the match, if the player has not stored their items in the safety box and they die during the match, the player will drop all items they carried with them to the pre-equipped items game mode for other players to steal.

There have not been too many similar examples in the mobile game market yet of extraction shooters, although PUBG Mobile has a similar mechanic in a recurring gameplay mode Metro Royale (which also draws inspiration from Escape from Tarkov).

Survival shooters

These shooters revolve around a survival theme, often in a post-apocalyptic environment featuring zombies or other threats. These games usually feature detailed weather, hunger, and health mechanics (among others), which need to be considered during the game to survive. Exploration and resource-gathering play a big part in these games in addition to combat, with some survival games also implementing shooter mechanics.

There are only a few mobile titles in the Western market that specifically focus on survival gameplay, and currently, there are no shooter survival games among the top-grossing ranks on the US iOS platform. However, some top-down survival games, such as The Last Day on Earth: Survival, have managed to gain popularity.

On the contrary, the PC and console market has a number of survival shooters, including the zombie-filled DayZ and post-apocalyptic Rust. Both titles feature a wide area to explore with other players, combining PvE and PvP elements. DayZ has enormous maps, with the main threat stemming from zombies, with occasional encounters with other players. In Rust, the main danger is other players, even though there are also some PvE elements. The biggest differentiator between the two is Rust’s base-building focus, which can be done solo or with others.

Arena Breakout, LifeAfter, and Undawn in the Chinese mobile game market incorporate some elements into their gameplay. Undawn is interesting because it’s a new survival title that recently hit the Chinese and Western mobile markets.

Around its launch in the CN iOs market, the game peaked at the top-grossing position 6 but has since dropped outside the CN top-grossing 200, currently sitting at the top-grossing rank of 371 and sustained download rank of 183. In the US iOs market, the game is lingering in the sustained top-grossing rank 324 and the sustained download rank 260, but has not quite yet reached the top-grossing 200.

Undawn is a third-person survival shooter with MMO traits where the player is trying to survive the zombie apocalypse. It is similar to the survival MMO LifeAfter, which has even been visiting the US top-grossing 200.

In Undawn, players partner up to survive the punishing world to complete various tasks. There is a heavy storytelling aspect, with cutscenes regularly interspersed between gameplay featuring several main characters. The game also includes detailed survival mechanics. Players must consider their character’s physical health, hygiene, and sleep level, as well as prepare for changing weather conditions to survive.

Typical of a Chinese midcore game, Undawn has plenty of cosmetic items for the character and a home system, which can be decorated with various buildings. Upgrading the home system is a crucial part of progression, as the player can’t continue upgrading their character if their home level is too low. This, and many other aspects of the game, require a lot of resource collecting—such as collecting berries from the forest or shooting animals. Collected materials are then used to create many items needed in the game, including weapons and food.

The game has two main focuses for monetization: cosmetic economy and material purchasing. Cosmetic items (for the character and their home system) can be purchased immediately or with gachas. Material items are needed for crafting equipment items, such as guns and armor, which are tied to power progression. These items can either be collected or purchased right away from the store.

This type of monetization differs significantly from that of the top US iOS shooter games since the focus is on materials rather than upgrading or collecting characters and weapons.

Looter shooters

RPG-like looter shooters are another subgenre absent from the mobile game market. The idea of these games is to have some RPG elements (storytelling, character progression) combined with looting and shooting. There is usually a massive open area to explore, and the main aim is to kill off other players and AI-controlled enemies. In the PC and console sphere, these include titles such as Destiny and The Division, the latter of which has officially announced a mobile version.

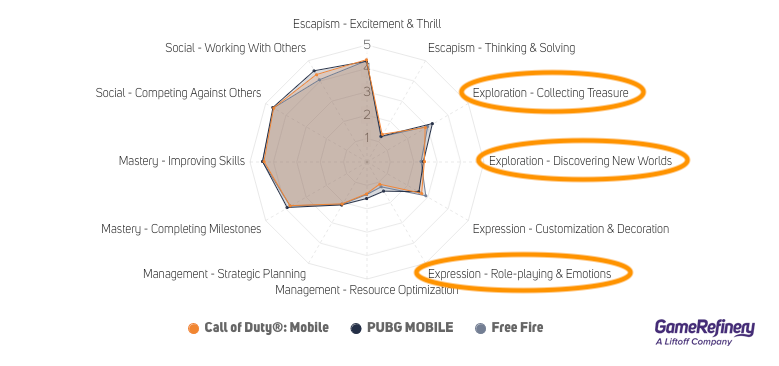

This type of shooter could answer some of RPG players’ motivations. When looking at our motivation data, we generally find a few motivations that are being neglected by developers or don’t feature in high positions in the US iOS top-grossing shooter games. These include the exploration of new worlds, collecting treasure, role-playing and emotions.

Looking at the above picture, notice how these three motivational aspects are not highlighted in the most popular shooters:

- If the focus were shifted more towards storytelling, RPG players would find it easier to become immersed in the game through its narrative.

- The motivation to collect treasure already has quite a high position in many top shooter games, but the open-world experience could enhance this aspect even further if the player could loot items on a larger scale.

- The third motivation, exploring new worlds, needs to be added to most top-grossing shooter games. Having a larger area to explore would scratch that itch.

Tactical FPS games

Another genre rarely seen on mobile is tactical FPS. Similar to extraction shooters, these focus more on tactical, slow-paced gameplay. Players usually form a team of five and compete against others in purely PvP gameplay. In the PC and console sphere, some of the most well-known titles include Counter-Strike and Valorant, the latter of which is rumored to be launching a mobile version soon.

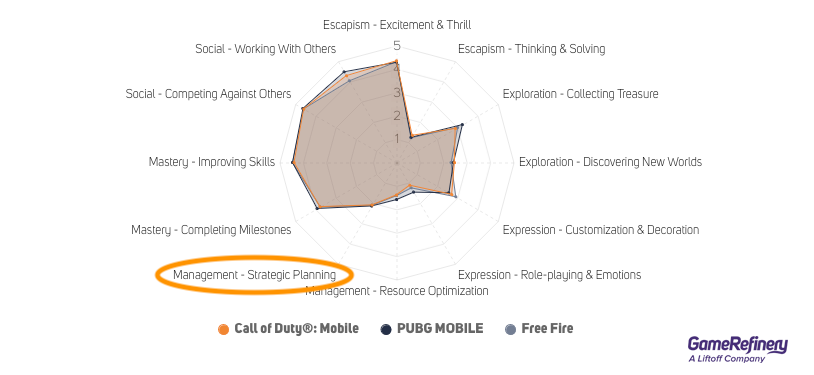

When looking again at our motivation data, we noticed that the top three shooter games are missing one aspect which features prominently in tactical FPS games: strategic planning.

Out of all the subgenres we’ve listed, tactical FPS is likely the most rarely encountered on mobile, although some examples remain. Critical Ops is a competitive FPS game similar to Counter-Strike with smooth gameplay and realistic graphics. The focus is on highly competitive, skill-based gameplay with a high learning curve, and the game also has eSports and live tournaments, which occasionally offer real-money prize pools.

Despite being one of the most successful tactical FPS games on mobile, it has not appeared in the top-grossing ranks for a substantial period of time. This is likely down to the game being developed by a fairly small studio, which lacks the necessary resources to acquire new users and encourage growth. A larger studio with more capacity would likely fare better.

One to avoid: Battle Royale

The overwhelming popularity of Fortnite has meant that the battle royale subgenre has become a huge aspect of mobile gaming, and shooters are no exception—with each of the top-three shooters dominating the market. As a result, it has become increasingly difficult for new titles to establish themselves.

A prime example of this is Apex Legends Mobile. As a smartphone version of the popular PC and console game, Apex Legends Mobile launched with a breadth of exciting features and content owing to its big screen counterpart and featured unique ‘Legends’ characters that differentiated it from other battle royale games on the market. Despite this, the game could not gain a stable position in the market and was eventually shut down.

While we can only speculate the reasons behind this, we suspect it may have been down to the demands of maintaining the game’s LiveOps strategy (which ran separately from its console counterparts) mixed with the immense competition it faced from the three shooter giants. With that in mind, we’d recommend smaller studios to steer clear of this subgenre for now.

Summary

With an 80% share of the Western market, Call of Duty: Mobile, Free Fire, and PUBG Mobile share a firm hold on the mobile shooter throne. Their resource-heavy cosmetic monetization model, combined with their popularity on other platforms (at least in the case of Call of Duty and PUBG), will make it challenging to knock these three titans off their podium.

Other shooters will have the best chance of breaking into the market if they can introduce some fresh core gameplay ideas. Given the strength of the power three and other mobile monoliths such as Fortnite, that will mean most developers should steer clear of the Battle Royale genre – or else risking a fate similar to Apex Legends.

Looter shooters are a relatively untapped market on mobile and could tie into the motivations of many players by featuring narrative elements and exploration through a large open-world. That being said, Ubisoft plans to bring The Division to mobile, and Bungie looks set to follow with Destiny, meaning this space may soon become crowded.

Survival and extraction shooters have a handful of popular titles in the Chinese market, but these subgenres are yet to make a big impact in Western markets despite their popularity on console and PC platforms, suggesting there are many gains to be had.

Tactical shooters are also almost unheard of on mobile, suggesting it might be difficult to translate this type of gameplay onto a small screen successfully. Critical Ops has proven it can be done, although this title hasn’t made much impact in terms of revenue. We suspect a larger studio with the capacity to further push UA, and even perhaps collaborate with other IP to drum up interest, would fare better.

If you enjoyed this post and wish to explore this topic even further, then check out some of our other content:

- Episodes 25 and 44 of our podcast discuss the mobile shooter market in depth.

- Delve into Liftoff’s 2023 Midcore Gaming Apps Report

- Use our new LiveOps tools to inspect the framework of the highest-grossing shooters